How to Write a Debt Collection Letter: Simple Swipe File Samples for Your Business

Managing accounts receivable is getting more challenging. With commercial debt in the USA at 24.68% of total lending — the highest among developed nations — businesses are feeling the pressure to maintain steady cash flow. And it's not getting easier: consumer credit has dropped by 1.8% as of November 2024, making collection efforts even more critical.

If you're running a business, you've probably dealt with late payments. We get it — chasing down overdue accounts isn't fun, but it's essential for your bottom line. The good news? The debt collection industry is adapting fast, with AI solutions transforming how businesses handle receivables. In fact, the AI debt collection market is expected to grow from $3.34 billion to $15.9 billion by 2034.

A well-written collection letter can make a big difference in getting paid. But writing one that's both effective and professional isn't always straightforward. You want to be firm but fair, direct but respectful. That's why we've put together proven templates and strategies that work in today's business environment.

In this guide, you'll learn exactly how to craft collection letters that get results, backed by data and real-world experience. We'll show you specific examples you can adapt for your business, keeping you compliant while improving your chances of successful collection. And with the debt collection industry growing at 9.9% this year, having these tools in your arsenal is more valuable than ever.

Let's talk about something that affects most businesses today: debt collection letters. With 93% of companies dealing with late payments, getting these letters right is crucial for your cash flow. And here's a tough reality — 80% of companies have trouble collecting what they're owed. But don't worry, we'll help you write letters that actually get results.

Your approach to collection letters needs to match where you are in the payment cycle:

Writing these letters can feel like walking a tightrope — you want to be firm but not aggressive, friendly but not pushover. That's why tone matters so much. A well-written letter can speed up your AR collection periods and keep your business relationships strong.

Being professional doesn't mean being cold. Show that you get it — sometimes businesses face cash flow challenges. But also be clear about what you need and when you need it. Your goal is to get paid while keeping the door open for future business.

Speaking of getting paid faster, AI-driven A/R automation is changing how businesses handle collections. These systems can help you track, send, and follow up on collection letters automatically, giving your team more time to handle complex cases that need a personal touch.

Here's what we've learned works best:

This approach has helped many of our clients reduce their collection times significantly. And if you're dealing with complex AR processes, automation might be worth looking into — it's made a big difference for businesses managing multiple accounts.

Writing a great collection letter is all about getting the details right. Let's break down what makes these letters work — and what you'll need to include to get the response you want.

You'll want to open your letter with clear details about who owes what. Include the full name, address, and account numbers right at the top. And don't forget that original invoice number — it helps your customer find the right paperwork on their end.

Break down exactly what's owed. If you've added any interest or late fees, spell those out too. When you're upfront about the numbers, you'll probably get fewer questions later. Speaking of money matters, understanding payee vs payer relationships can help you write more effective collection letters.

Make it easy for your customers to pay you. Different businesses prefer different payment methods, so offer a few good options. Set a clear deadline, and maybe mention that secure payment link or mailing address. The easier you make it, the faster you'll get paid.

Put your contact info where it's easy to spot. Phone number, email, when you're in the office — all the basics. You might get questions, and that's okay. Actually, a quick call can sometimes sort things out faster than trading emails back and forth.

Wrap up your letter with exactly what you want them to do. Something like "Please send your payment by March 15" works well. It's direct but professional, and there's no confusion about what needs to happen next.

By the way, if you're handling lots of these letters, automation can help. Modern AI systems can track deadlines, send follow-ups, and even customize letters based on payment history. This frees up your team to handle the trickier cases that need a personal touch.

Want to make your collection process even smoother? Our team can show you how automation handles these tasks — and many others — while keeping everything organized and professional.

The legal side of debt collection might seem complex, but it's actually pretty straightforward when you break it down. The Fair Debt Collection Practices Act (FDCPA) lays out the ground rules, and they're really about being fair and professional when collecting debts.

You can't harass people about their debts — that means no threats, no bad language, and no calling again and again to annoy them. And timing matters too. Calling someone at 3 AM about a debt? That's not going to work out well for anyone.

Sometimes you'll get asked to prove the debt is real. When that happens, you've got to show the paperwork. It's a good practice anyway — keeping clear records helps everyone understand what's going on.

Being professional doesn't mean being cold. You can be firm about what's owed while still treating people with respect. Sometimes, offering a bit of flexibility with payment options can go a long way. After all, most people want to pay their debts; they might just need some help figuring out how.

Technology is making debt collection smoother for everyone. Proactive AI payment reminders are changing how businesses handle collections, taking the awkwardness out of follow-ups. And the industry is noticing — Fazeshift recently raised $4M in a seed round to build better AR automation tools for everyone to reap the benefits of it.

Following the rules keeps you out of legal trouble, while also helping to maintain good relationships with your customers. Technology can help you stay compliant while making the whole process more efficient. Modern AI systems can track deadlines, send reminders at the right times, and keep perfect records of all communications. This way, you're following all the rules while saving time and energy for other important tasks.

Let's talk about making your collection letters more effective. It's not rocket science, but there are some tried-and-true approaches that'll help you get better results.

Start with the basics — make it clear who you're writing to and what they owe. You might want to mention their client ID or invoice number too. And always spell out the payment options. Making it easy for people to pay really does speed things up.

Nobody likes getting generic form letters. When you use someone's name and mention specific details about their account, they're more likely to respond. And while you're being personal, stay professional — you can be firm about what's needed without being aggressive.

This part's pretty important. You want to be clear and direct, but not harsh. Sometimes people are going through tough times, and a little understanding goes a long way. That said, you still need to be firm about getting paid.

Having a good follow-up plan can make a big difference. And speaking of follow-ups, a well-crafted dunning letter can work wonders as part of your collection strategy.

Here's a timeline that works well:

You'll want to include:

By the way, automation can really help with all of this. Modern systems can track which letters to send when, follow up automatically, and even adjust the tone based on the customer's payment history. This way, your team can focus on the cases that need a more personal touch.

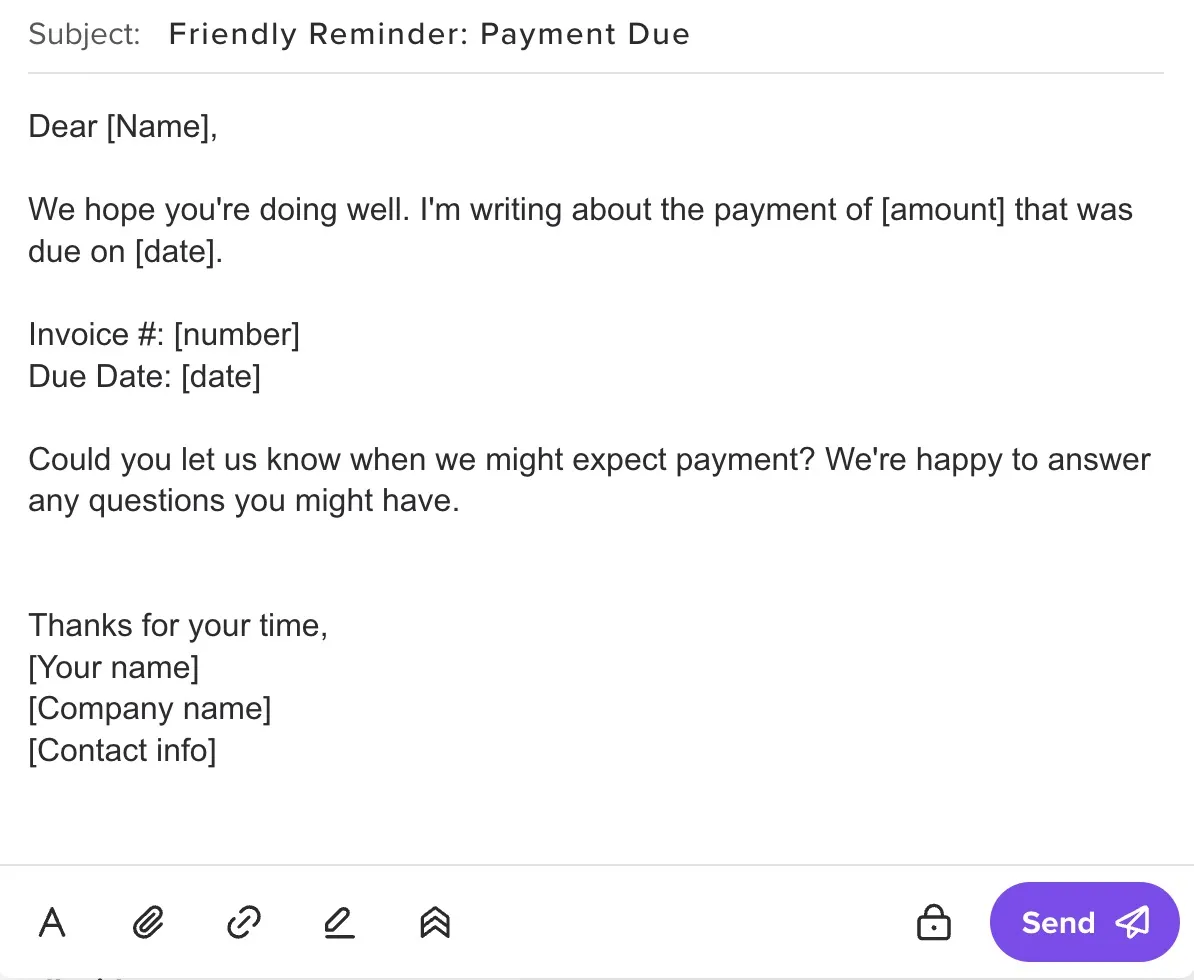

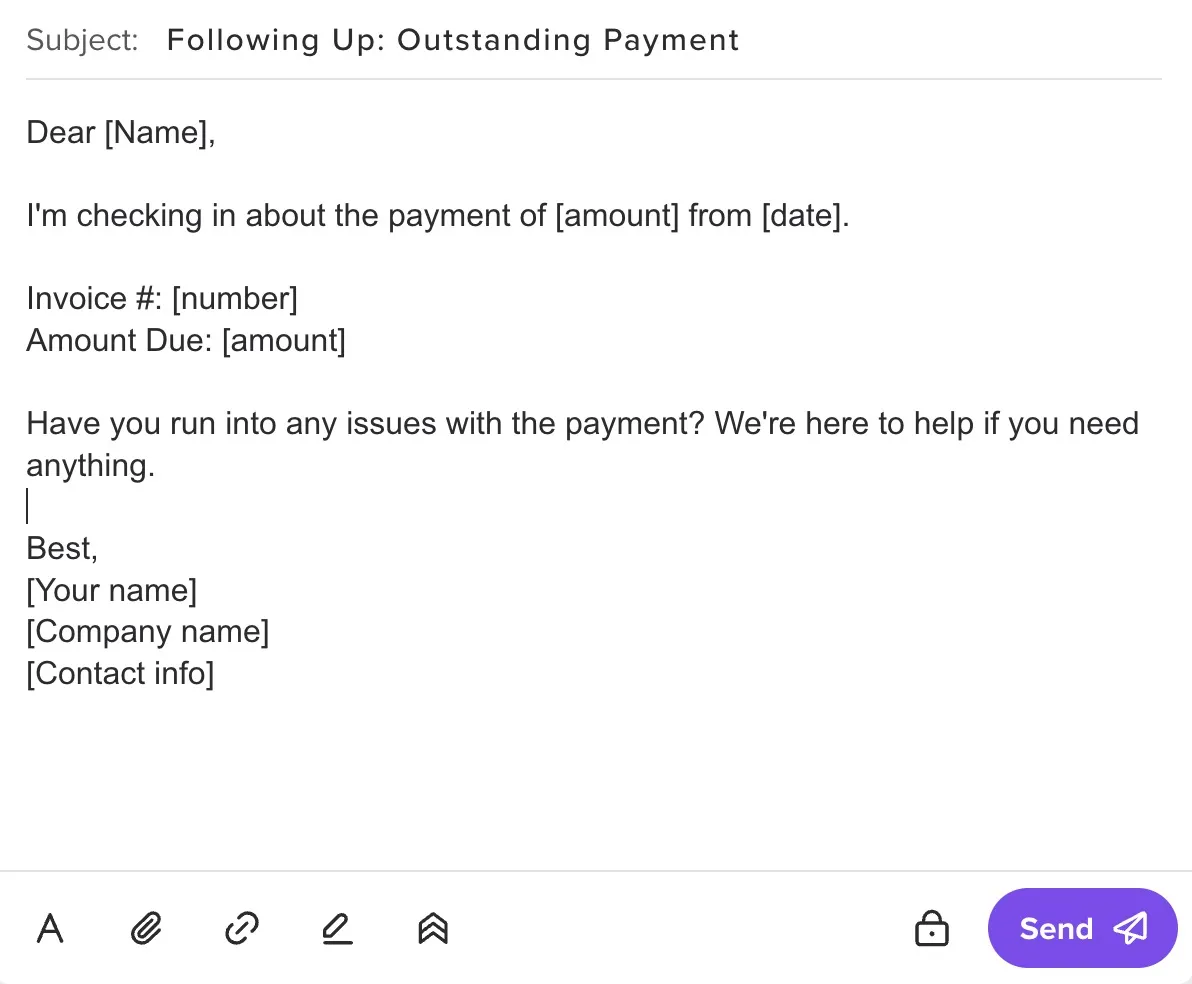

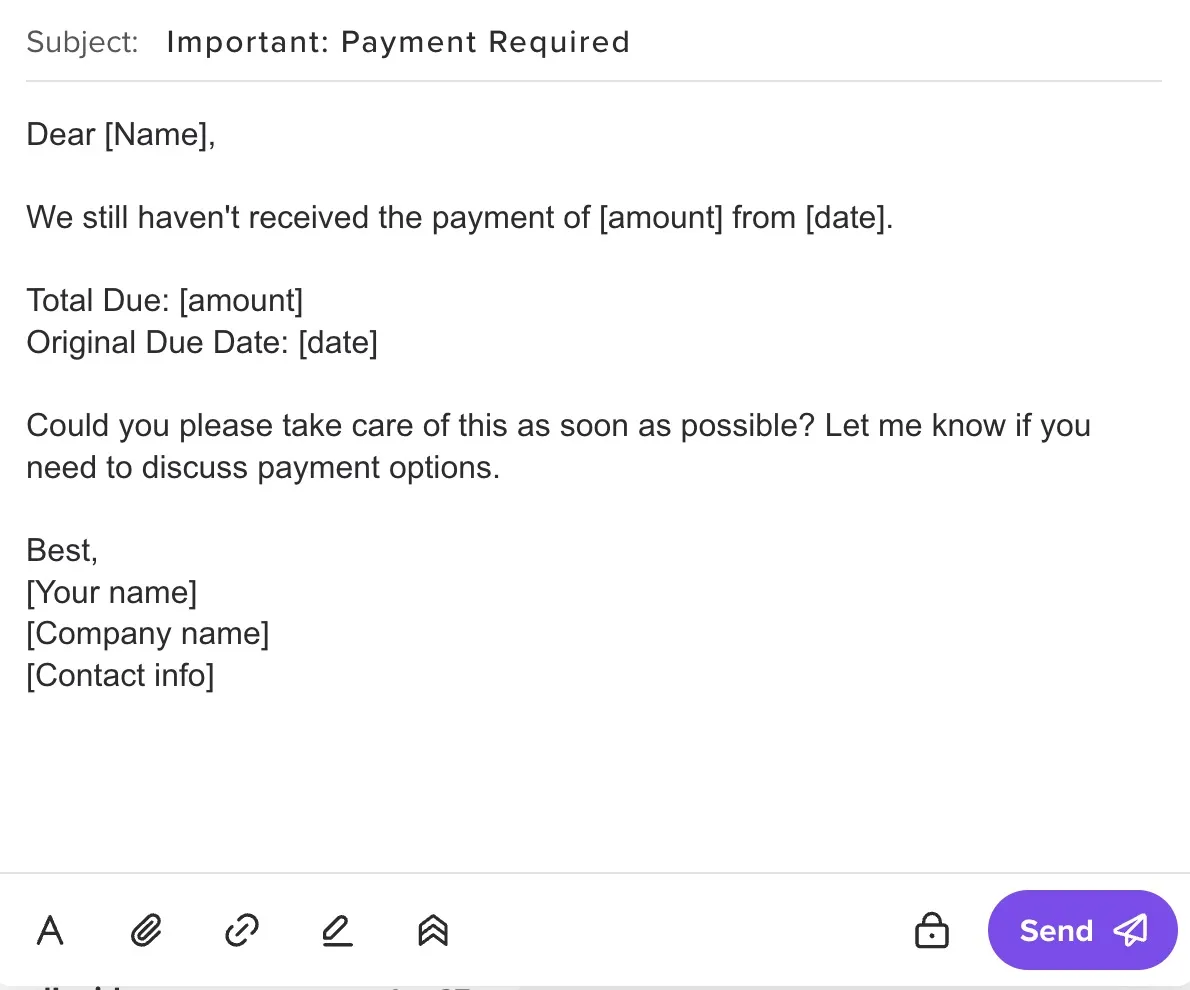

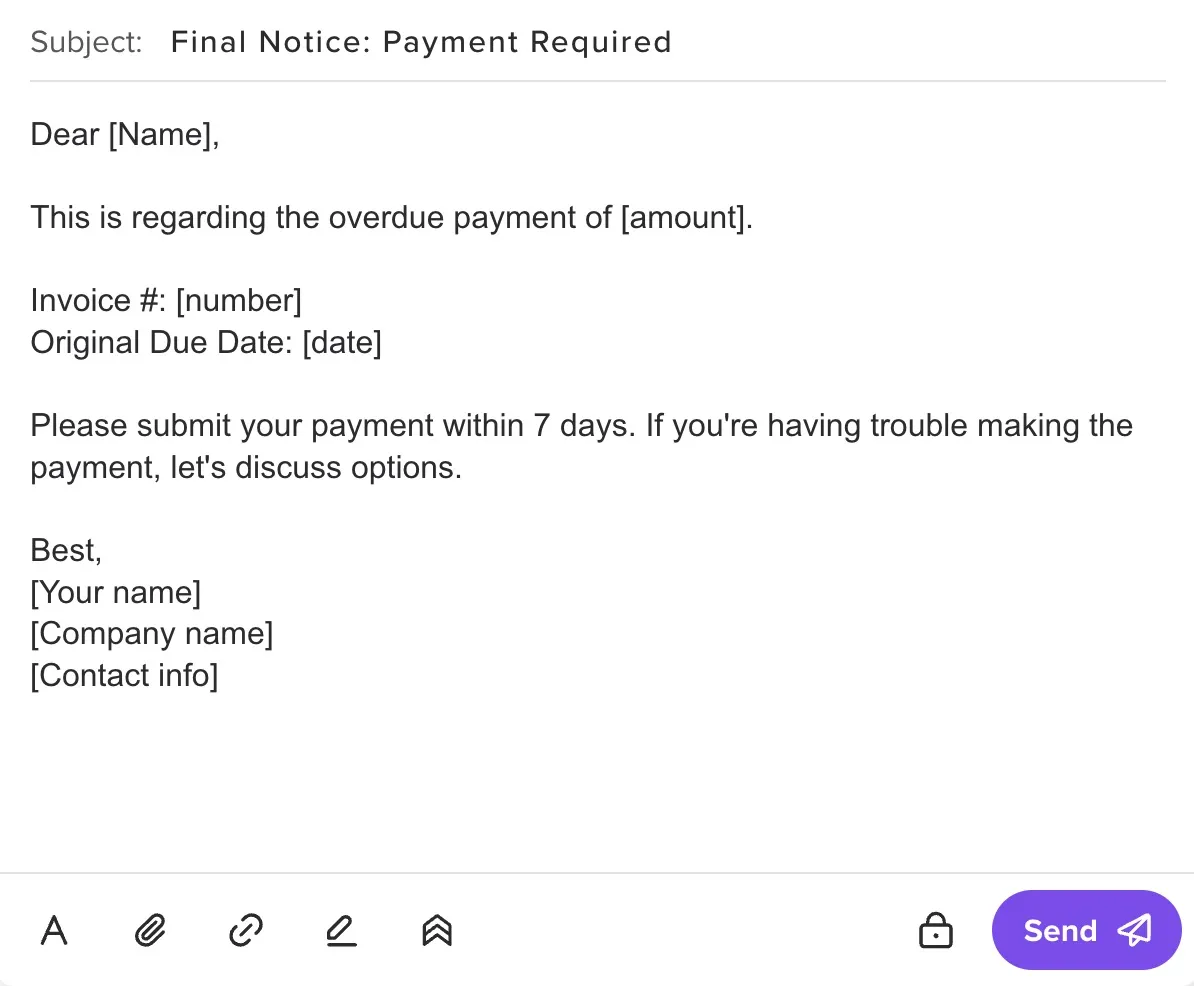

Here are some straightforward templates you can start using today. These are real examples that work well in different situations — from the first friendly reminder to the final notice. And you can adjust them to match your company's tone and needs.

Feel free to modify these templates based on your relationship with the customer and your company's style. The key is keeping things professional while being clear about what you need. And don't forget — timing matters. Send these at reasonable intervals to give people a chance to respond.

Getting your debt collection letters right can really transform how quickly you get paid. The approach is simple: start friendly, keep it professional, and stay consistent with your follow-ups. When you combine well-written letters with smart timing, you've got a system that works.

Today's AR teams face a lot of pressure managing collections at scale. And while these templates give you a great starting point, handling hundreds or thousands of accounts manually takes up valuable time your team could spend on more strategic work.

That's where automation comes in handy. Whether you're sending that first gentle reminder or following up on seriously overdue accounts, modern AI tools can help streamline the whole process. Your team gets to focus on building relationships and handling complex cases, while the system takes care of the routine tasks.

Want to see how automated collection letters could work for your business? Schedule a quick demo today — we'll keep it focused on what matters to your AR team.

Eliminate manual bottlenecks, resolve aging invoices faster, and empower your team with AI-driven automation that’s designed for enterprise-scale accounts receivable challenges.