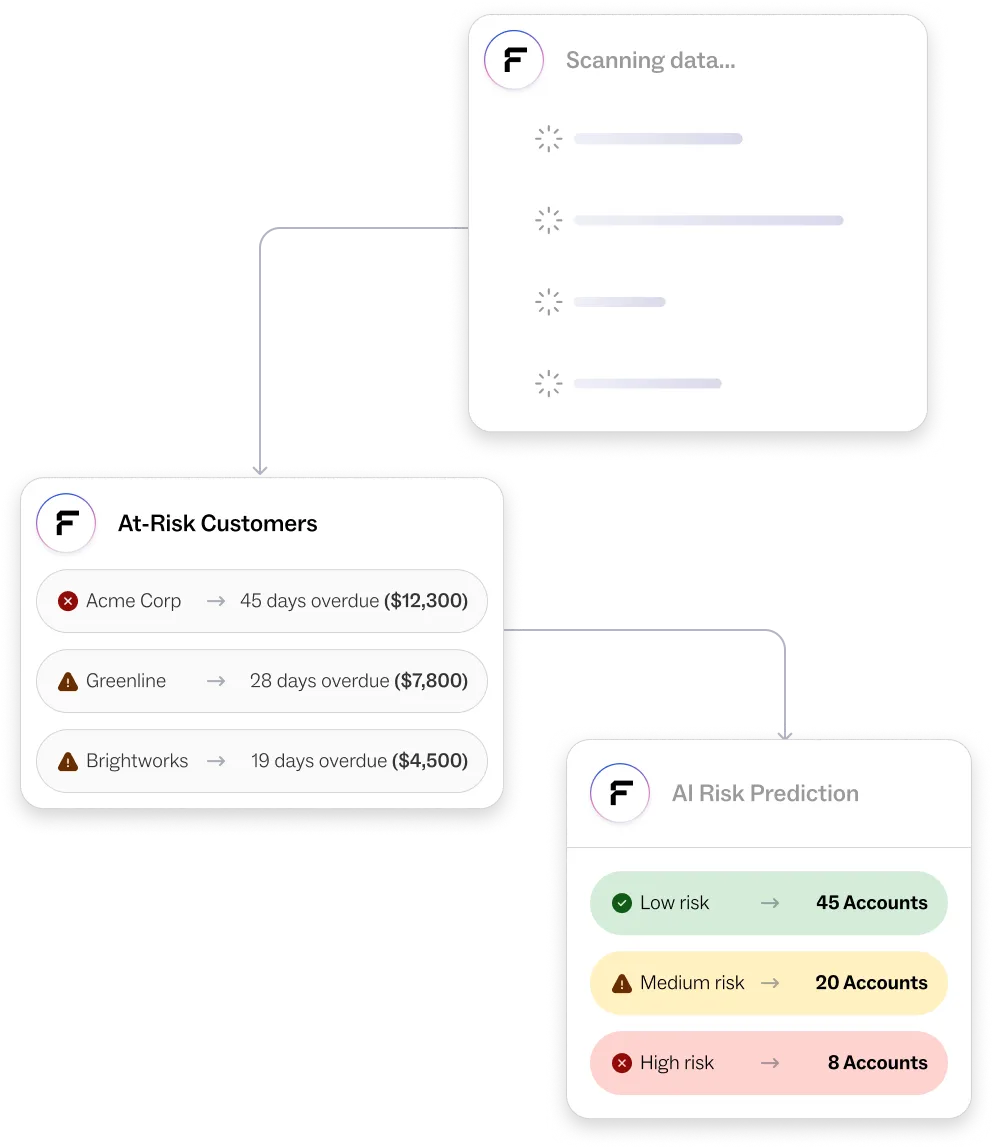

Make Informed Decisions To Avert Bad Debt

Leverage automation that works with the technology you’re already using to remove bottlenecks and crush time-consuming tasks.

Monitor credit risk in real time, flag at-risk accounts, and recommend next steps so your team can make smart decisions without all the manual work.

.webp)

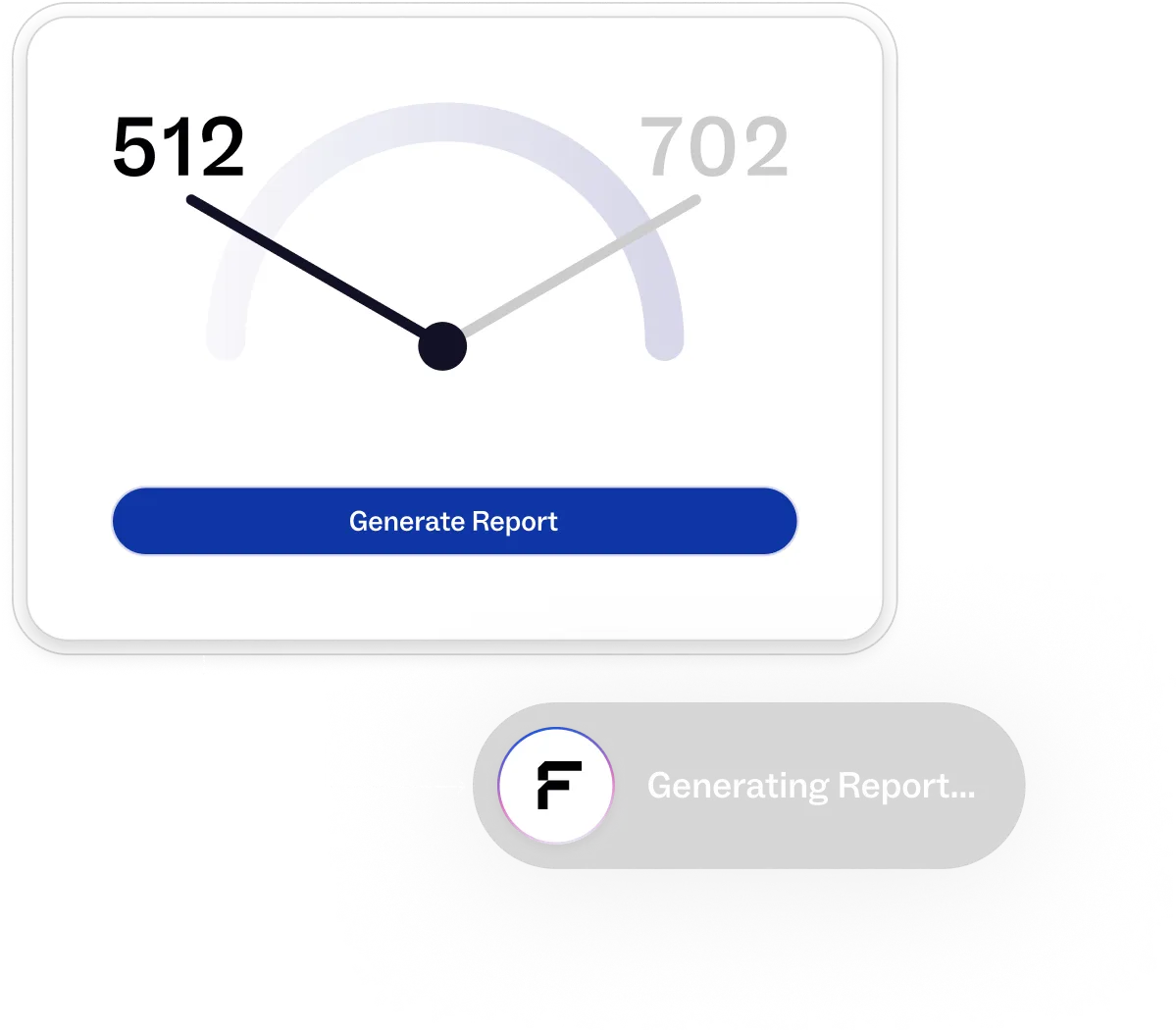

Make Wise Credit Decisions Quickly

Tap into real-time insights and intelligent automation to stay ahead of risk, protect your revenue, and reduce the manual work behind credit reviews.

Real-Time Risk Monitoring Within Reach

Instantly access up-to-date data from your ERP and CRM to track customer payment behavior, outstanding balances, and aging schedules so you never miss a warning sign.

Smart Automation That Reacts to Risk

Set dynamic triggers that automatically flag customers for credit reviews based on changes in risk score, high outstanding balances, or overdue invoices to keep your cash flow protected.

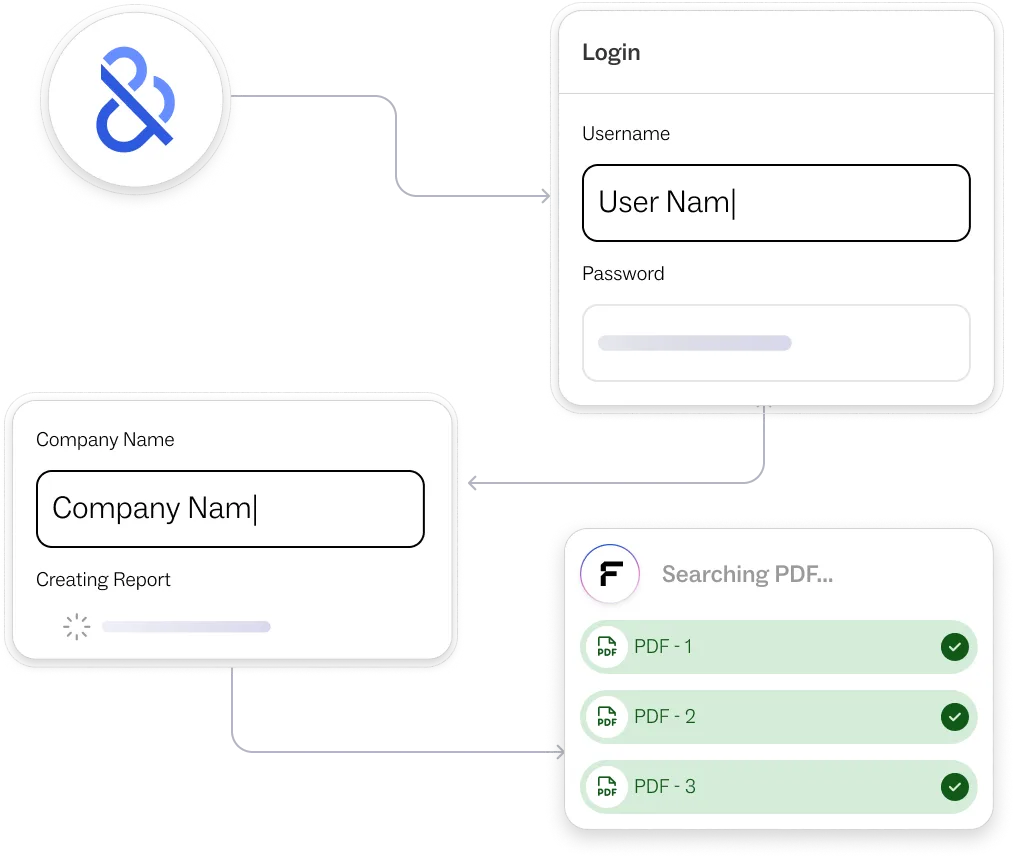

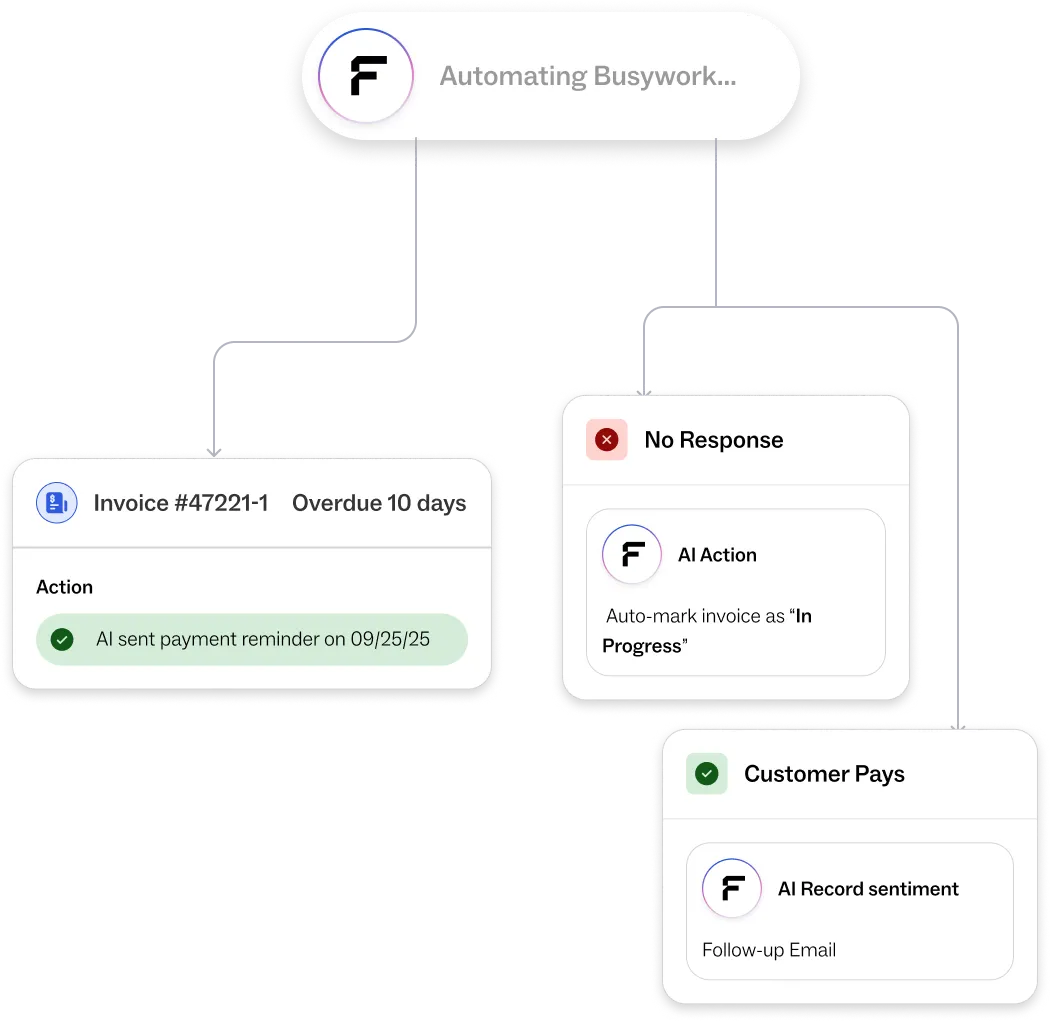

Automate Busywork And Accelerate The Right Calls

Route credit reviews to the right teams with the right data, and get AI-backed recommendations that help you adjust limits quickly and appropriately.

Seamless Task Management for Credit Reviews

Automatically generate and route credit review tasks with all the critical account details so your collections and risk teams stay focused and informed in real time.

AI-Powered Credit Limit Recommendations

Leverage intelligent analysis to receive tailored credit limit adjustments, from increases for strong payers to freezes or reductions for high-risk customers.

Stay Ahead And In Sync

Automatically monitor customer risk and alert your teams the moment action is needed so credit issues never catch accounts receivable off guard.

Protect Your Revenue with Automated Risk Controls

Monitor customer risk continuously, flag issues early, and streamline credit management to reduce bad debt and make your cash flow more predictable.

Proactive Communication Across Teams

Keep everyone aligned by notifying teams when credit limits change so they can take action, such as pause orders or escalate collections.

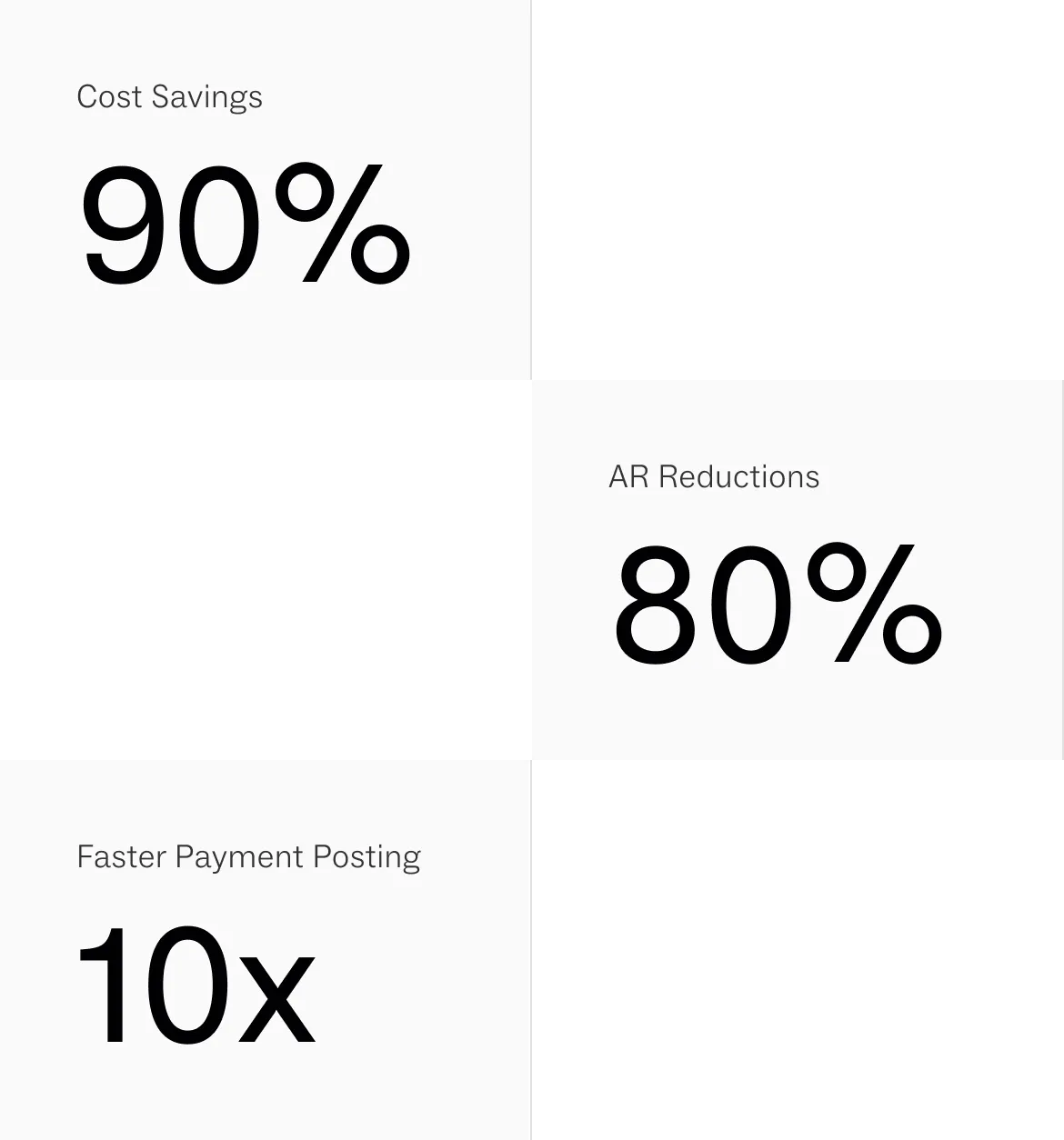

Streamline Receivables And Accelerate Your Growth

Automate tedious accounts receivable tasks to reduce costs, cut outstanding invoice balances, and speed up payment posting.

.webp)

Your All-In-One Accounts Receivable Automation Solution

Effortless Billing Setup

Eliminate manual data entry and streamline billing by capturing customer details through onboarding forms that automatically sync with your ERP system.

Achieve Accurate Payment Matches

Automatically match customer payments to open invoices even for complex scenarios like parent-child accounts, partial payments, and multiple invoices.

Offer A Branded Source Of Truth

Reduce friction and support requests by offering a seamless, self-serve portal where customers can update their billing information, view invoices, pay them, and more.

What our customers are saying

Our AI agents deliver unparalleled results through the reduction in days sales outstanding, time saved, and so much more, but don’t just take our word for it.

The Fazeshift team took the time to understand our specific needs and used the platform’s flexibility to build custom financial operations workflows and design dashboards specific to each account manager. Our team has become more organized using Fazeshift, leading to improved efficiency in tracking and collecting, and we're now expanding into Fazeshift’s Task functionality to streamline even more.

Fazeshift has made it easier and much more efficient for us to apply payments and systematically contact our customers with payment reminders. Our overall AR balance has dropped 20% since we started to use Fazeshift, and our team is able to count on Fazeshift's products and customer support to streamline our critical business operations.

Credit Management Explained

Get the answers to common questions about credit management and best practices.

Smarter Credit Starts Here

See what automated credit management really looks like, with real-time insights, intelligent workflows, and proactive alerts that can help your team stay ahead of risk and focused on growth.

Order-to-cash automation that works

See how effortless billing automation can accelerate your revenue, eliminate manual bottlenecks, and reduce errors that can lead to payment disputes.